Decoding Investor Psychology: How AI Uncovers Behavioral Biases for Smarter Decisions

We’ve all been there. The market takes a sudden nosedive, and a wave of panic washes over you. Your finger hovers over the “sell” button, every instinct screaming to cut your losses before they get worse. Or perhaps you’ve held onto a losing stock for far too long, convinced it will rebound, only to watch it sink further. This isn’t a failure of intelligence; it’s a classic case of investor psychology at work. For decades, the greatest obstacle to wealth creation hasn’t been market volatility, but the predictable irrationality of the human mind.

Welcome to the world of behavioral finance, a field that merges psychology and economics to understand why we make the financial choices we do. It acknowledges that we are not the perfectly rational beings traditional economic models assume us to be. We are driven by fear, greed, overconfidence, and a host of other cognitive biases investing that systematically sabotage our portfolios. The human error in finance is not a bug; it’s a feature of our evolutionary wiring.

But what if you had a co-pilot? An eternally rational, data-driven partner that could spot your behavioral blind spots in real-time and gently nudge you toward more logical choices? This is no longer science fiction. The integration of AI in investing is creating a paradigm shift, moving beyond simple stock-picking algorithms to tackle the root cause of poor returns: our own psychology. This article explores how AI is decoding the complex landscape of investor behavior, identifying deep-seated biases, and empowering us to make truly smart financial decisions.

The Invisible Hand Sabotaging Your Portfolio: A Primer on Behavioral Biases

Traditional finance operates on the assumption that markets are efficient and investors act rationally, always seeking to maximize their returns. But if that were true, market bubbles and crashes fueled by mass panic wouldn’t exist. Behavioral finance provides a more realistic model, acknowledging that psychological factors in market dynamics play a massive role.

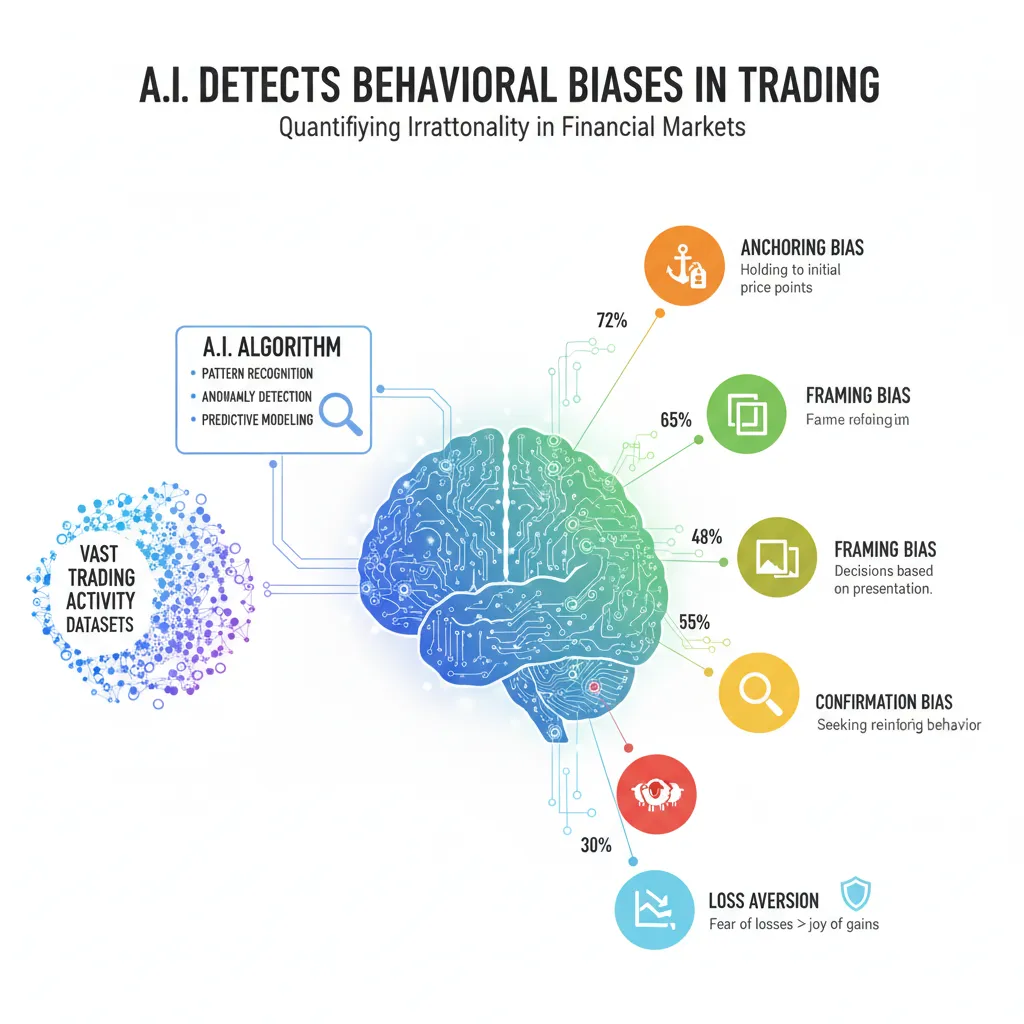

These psychological tripwires are known as cognitive biases. They are mental shortcuts, or heuristics in finance, that our brains use to make quick judgments. While useful in everyday life, they become incredibly costly when applied to the complex world of investing. Let’s break down the most common culprits.

The “I Knew It All Along” Trap: Overconfidence Bias

Overconfidence bias investing is the tendency to overestimate one’s own knowledge and ability to predict outcomes. An investor might trade excessively, believing they can consistently outperform the market, racking up transaction fees and taking on unnecessary risk. They might concentrate their portfolio in a few “hot” stocks they’ve “researched,” ignoring the proven benefits of diversification. This is often amplified by hindsight bias, where past successes feel like the result of skill rather than luck, reinforcing the cycle of overconfidence.

Anchors Aweigh: The Danger of Fixating on the First Number

Anchoring bias finance occurs when we rely too heavily on the first piece of information we receive. For an investor, this “anchor” is often the purchase price of a stock. If the stock’s value drops, they may be reluctant to sell, anchored to the original price and hoping it will return to that level, even if underlying fundamentals have changed. This prevents them from objectively evaluating the investment’s current prospects and can lead to holding onto losing assets for far too long.

Following the Crowd Off a Cliff: Herding Behavior

Humans are social creatures, and this instinct bleeds into our financial lives. Herding behavior stock market describes the tendency for investors to follow the actions of a larger group, whether buying or selling. This is driven by a fear of missing out (FOMO) on a rising stock or panic-selling during a downturn because everyone else is. Herding ignores an individual’s own research and strategy, leading them to buy high and sell low—the exact opposite of a sound investment strategy.

The Pain of Losing is Twice the Pleasure of Gaining: Loss Aversion

Psychological studies have shown that the pain of a loss is felt about twice as strongly as the pleasure of an equivalent gain. This is loss aversion investing. It explains why investors might sell winning stocks too early to lock in a small profit but hold onto losing stocks indefinitely, because realizing the loss makes it feel “real” and painful. This emotional investing behavior leads to unbalanced portfolios skewed towards underperforming assets.

It’s All in How You Frame It: The Framing Effect

The framing effect finance demonstrates how the presentation of information can drastically alter our decisions. A stock that has “declined 20% from its 52-week high” sounds much worse than one that has “gained 80% over the last two years,” even if both statements are true. Financial news and marketing often frame information to elicit an emotional response, influencing financial decision making in ways that may not align with an investor’s long-term goals.

The Human-Machine Alliance: How AI Steps in as the Rational Co-Pilot

Understanding these biases is the first step, but overcoming them is another challenge entirely. Our brains are hardwired for these shortcuts. This is where the powerful synergy of human oversight and artificial intelligence creates a new frontier in AI wealth management.

AI isn’t here to replace the investor. Instead, it acts as a dispassionate, logical co-pilot, analyzing data and behavior to provide a crucial layer of objectivity that is often missing when we’re left to our own devices.

Data-Driven Objectivity: Moving Beyond Gut Feelings

The core strength of AI is its ability to process and analyze trillions of data points in milliseconds, completely free of emotion. While a human investor might be swayed by a dramatic headline or a “hot tip” from a friend, an AI model focuses purely on the numbers. It scrutinizes:

- Market Data: Price movements, trading volumes, and historical trends.

- Fundamental Data: Company earnings reports, revenue growth, and debt levels.

- Alternative Data: Satellite imagery, social media sentiment, and news flow analysis.

This commitment to data-driven investment provides a stable, rational counterpoint to our often-erratic human emotions. By grounding decisions in evidence rather than feeling, AI helps steer us away from impulsive actions. Related: AI in Finance: Top Trends and Tools for 2024.

Real-Time Bias Detection and Nudging

The most revolutionary aspect of AI in investing is its ability to perform investment bias detection on an individual level. By analyzing your trading patterns, an AI-powered platform can learn your unique psychological profile.

- Do you tend to sell winners too soon? The AI might notice you consistently exit positions after a 10% gain, even if momentum indicators are still strong.

- Are you prone to panic selling? The algorithm can correlate your sell orders with periods of high market volatility and negative news sentiment.

- Do you exhibit herding behavior? The system can flag when you purchase a stock that has seen a massive, sentiment-driven spike in trading volume without a corresponding change in fundamentals.

Once a pattern is detected, the platform can intervene with a “nudge.” This isn’t about blocking a trade but about introducing a moment of friction. A pop-up might ask, “You are selling this asset during a period of high market fear. Is this decision aligned with your long-term financial plan?” This simple act of prompting reflection can be enough to break the cycle of reactive, emotional investing.

The AI Toolkit for Smarter Investing: From Detection to Correction

The application of Fintech behavioral science isn’t a single technology but a suite of tools working in concert. These systems are becoming increasingly sophisticated, offering personalized insights that were once the exclusive domain of elite wealth managers.

Machine Learning Models for Predictive Analytics

Machine learning finance models excel at identifying complex patterns that are invisible to the human eye. In the context of algorithmic trading psychology, these models are used for two primary purposes:

- Market Prediction: Forecasting asset price movements, volatility, and correlations based on historical and real-time data.

- Behavior Prediction: More importantly, predictive analytics investing can forecast how you are likely to react to certain market events. By understanding your susceptibility to specific biases, the platform can proactively offer guidance before you make a costly mistake.

These advanced analytical capabilities are becoming more accessible than ever, with many modern computers having the power to run complex models locally. Related: The Rise of AI PCs in 2024: A Game-Changer for Personal Computing.

Robo-Advisors 2.0: The Behavioral Coaches

The first generation of robo-advisors focused on automated investment advice based on modern portfolio theory—simple diversification and rebalancing. The next wave of robo-advisors behavioral finance platforms act more like digital financial therapists.

They go beyond a simple questionnaire to build a dynamic psychological profile of the user. They monitor trading activity, portfolio allocation, and even how often you log in during market turmoil. This data is used to deliver hyper-personalized advice. For example, for an investor prone to loss aversion, the platform might frame performance in terms of long-term goal attainment rather than short-term losses. These systems are becoming powerful autonomous assistants in our financial lives. Related: AI Agents are Here to Automate Your Digital Life.

AI-Powered Risk Tolerance Assessments

A classic problem in financial planning is that an investor’s stated risk tolerance is often different from their revealed risk tolerance. You might say you’re comfortable with risk when the market is calm, but your actions during a downturn might reveal you’re actually quite risk-averse.

Risk tolerance assessment AI solves this by using gamified scenarios and analyzing past behavior to determine your true comfort level with volatility. This allows for the creation of a portfolio that you’re more likely to stick with through thick and thin, preventing the disastrous cycle of abandoning a strategy at the worst possible moment. This is a cornerstone of effective AI personal finance.

Natural Language Processing (NLP) for Sentiment Analysis

To counteract herding behavior stock market, AI systems use Natural Language Processing (NLP) to scan millions of news articles, tweets, Reddit forums, and earnings call transcripts every day. The goal is to gauge the collective “mood” or sentiment surrounding a particular stock or the market as a whole.

By quantifying sentiment, the AI can alert an investor when a stock’s price is being driven by irrational exuberance or undue panic rather than its fundamental value. This provides a powerful, data-backed reason to avoid jumping on the bandwagon. This kind of content analysis is becoming a key feature across many AI applications. Related: The Complete Guide to AI Video Generators: From Text to Video.

Putting It All Together: A Tale of Two Investors

To see how this works in practice, let’s imagine an investor named Alex and see how his journey unfolds with and without the help of an AI financial advisor.

Scenario: Before AI

A new tech company, “InnovateCorp,” becomes a media darling. Alex sees articles and social media posts everywhere about its “revolutionary” new product. FOMO kicks in (Herding). He buys a large number of shares near the stock’s all-time high. A few months later, a competitor releases a better product. InnovateCorp’s stock begins to fall. Alex refuses to sell, anchored to his high purchase price (Anchoring Bias). He tells himself he’s a “long-term investor,” but he’s really just avoiding the pain of admitting a mistake (Loss Aversion). He eventually sells a year later for an 80% loss.

Scenario: With an AI Financial Advisor

When Alex first considers buying InnovateCorp, his AI platform sends him an alert: “Warning: Social media sentiment for this stock is extremely high and disconnected from its fundamental valuation. Purchases made under these conditions have historically underperformed.” This nudge makes Alex pause and do more research.

He decides to take a smaller position. When the stock begins to fall, the platform doesn’t just show him the loss. It reframes the data: “InnovateCorp now represents a disproportionately high-risk position in your portfolio. Rebalancing by trimming this position would improve your portfolio’s long-term projected returns.” By removing the emotional anchor of the purchase price and focusing on the logical goal of portfolio health, the AI helps Alex make the rational choice to cut his losses early. He’s able to confidently review his portfolio, knowing the decisions are backed by data, not emotion.

The Future of Investing is Here (And It’s Cognitive)

The integration of AI and behavioral finance is not a fleeting trend; it represents the future of investing. We are moving away from a one-size-fits-all approach to a world of hyper-personalized financial guidance. Your investment platform will know your goals, your risk tolerance, and your psychological triggers.

Of course, this future is not without its challenges. We must be vigilant about the potential for biases within the AI algorithms themselves and ensure robust data privacy protections. The human element of trust, empathy, and life-stage planning will always be crucial, meaning the most effective model will likely be a hybrid one, where AI financial advisors empower human professionals to serve their clients better. The latest advancements in on-device AI will likely play a huge role in making this technology both powerful and private. Related: Apple Intelligence: The Top AI Features Coming to iOS 18.

Conclusion: Forging a Smarter Investor

The greatest challenge in investing has always been the battle we fight with ourselves. The instincts that helped our ancestors survive on the savanna are the same ones that cause us to buy high and sell low. For the first time in history, we have a tool powerful enough to act as a mirror, showing us our own behavioral flaws in real-time.

By embracing the insights of behavioral finance and leveraging the analytical power of AI in investing, we can build a more rational, disciplined, and ultimately more successful approach to managing our wealth. The goal is not to eliminate our humanity from the equation but to augment it. By forging a partnership between our own goals and AI’s unbiased, data-driven investment analysis, we can finally overcome the psychological hurdles that stand between us and our smart financial decisions.

Frequently Asked Questions (FAQs)

Q1. What is the main idea of behavioral finance?

Behavioral finance is a field of study that argues that psychological influences and cognitive biases affect the financial decisions of investors and institutions. It challenges the traditional theory that investors are always rational, demonstrating how emotions like fear and greed, and mental errors like overconfidence or loss aversion, lead to predictable and often costly mistakes in the market.

Q2. How can AI help in investment decision making?

AI helps in investment decision making by processing vast amounts of data without emotional bias. It can identify market trends, analyze company fundamentals, gauge market sentiment through news and social media, and most importantly, detect an individual investor’s behavioral biases in real-time to provide “nudges” that encourage more rational, long-term thinking.

Q3. What are the 5 most common cognitive biases in finance?

While there are many, five of the most impactful cognitive biases in finance are:

- Overconfidence Bias: Overestimating your ability to predict market movements.

- Loss Aversion: Feeling the pain of a loss more acutely than the pleasure of a gain, leading to poor risk management.

- Herding Behavior: Following the actions of a larger group rather than your own analysis.

- Anchoring Bias: Over-relying on a specific piece of information, like a stock’s purchase price.

- Confirmation Bias: Seeking out information that confirms your existing beliefs and ignoring contradictory data.

Q4. Can AI predict investor behavior?

Yes, to a significant extent. By using machine learning models to analyze an investor’s past trading activity, portfolio changes, and reactions to market events, AI can build a highly accurate psychological profile. This allows it to predict how an investor is likely to behave under certain conditions (e.g., panic-selling during a crash) and offer proactive guidance.

Q5. Are AI financial advisors better than human advisors?

AI and human advisors have different strengths. AI excels at data analysis, bias detection, and executing tasks with speed and objectivity. Human advisors excel at understanding a client’s complex life goals, providing empathy, and building long-term trust. The most powerful model is a hybrid one where AI tools empower human advisors to provide even better, more personalized service.

Q6. What is an example of emotional investing?

A classic example of emotional investing is panic selling. This occurs when an investor, driven by fear during a market downturn, sells their investments to avoid further losses, often near the market bottom. This locks in losses and prevents them from participating in the eventual recovery, severely damaging long-term returns.

Q7. How do you overcome investment bias?

Overcoming investment bias involves a combination of self-awareness and systematic processes. Key strategies include creating and sticking to a detailed investment plan, automating investments to reduce decision-making, focusing on diversification, and using AI-powered tools and platforms designed to identify and alert you to your specific behavioral patterns before you make a costly emotional decision.