AI-Powered Investing: Predictive Analytics for Smarter Financial Decisions

Introduction

For decades, the world of investing has been a complex dance of human intuition, painstaking research, and a healthy dose of luck. Wall Street legends were built on gut feelings and the ability to “read the market.” But what if you could augment that intuition with the power to analyze billions of data points in a fraction of a second? Welcome to the new era of AI-powered investing, a transformative shift where predictive analytics and machine learning are no longer science fiction but essential tools for making smarter financial decisions.

The financial landscape is undergoing a seismic revolution. The days of relying solely on quarterly reports and analyst ratings are fading. Today, the market moves on everything from geopolitical news and social media sentiment to satellite imagery of shipping ports. For the human mind, processing this deluge of information is impossible. For Artificial Intelligence, it’s just another Tuesday.

This article is your comprehensive guide to understanding this new frontier. We’ll demystify how AI investing works, explore the powerful financial AI tools available to everyone from hedge fund managers to retail investors, and unpack the incredible potential of AI stock market predictions. You’ll learn how this technology enhances investment strategies, manages risk, and is ultimately democratizing investing AI for a new generation. Let’s dive into the data-driven future of wealth creation.

What is AI-Powered Investing? Demystifying the Digital Crystal Ball

At its core, AI-powered investing uses artificial intelligence, primarily machine learning in finance, to analyze massive datasets and make investment decisions. Instead of relying on human emotion or limited analysis, these intelligent investing systems execute trades, manage portfolios, and identify opportunities based on complex algorithms and statistical models.

Think of it as the ultimate evolution of quantitative analysis. While traditional “quant” strategies have used mathematical models for years, AI takes it a quantum leap further. Here’s how:

- Machine Learning (ML): This is the engine of AI investing. ML algorithms learn from historical data to identify patterns and predict future outcomes without being explicitly programmed. For example, an algorithm can analyze 30 years of stock market data to learn which economic indicators most often precede a market downturn.

- Deep Learning: A subset of ML, deep learning uses neural networks with many layers (hence, “deep”) to uncover incredibly subtle and complex patterns. This is the technology used to analyze unstructured data like news articles or social media posts for market sentiment.

- Natural Language Processing (NLP): NLP gives machines the ability to read, understand, and interpret human language. In finance, this means an AI can scan thousands of news reports, earnings call transcripts, and tweets in real-time to gauge the sentiment around a specific company or the market as a whole.

This AI impact on finance is profound. It moves investing from a field dominated by interpretation and gut feelings to one grounded in data driven investing, where decisions are backed by a scale of evidence no human could ever assemble.

The Engine Room: How Predictive Analytics is Revolutionizing Finance

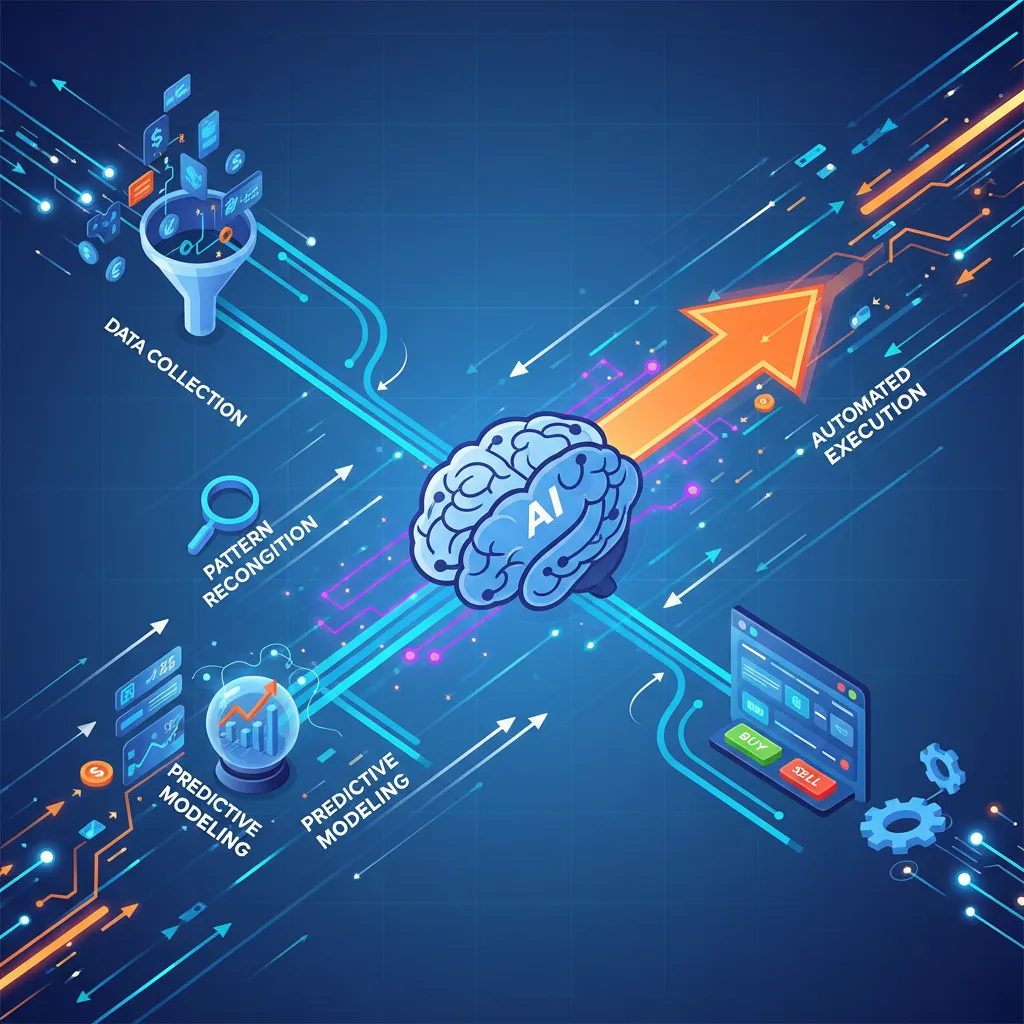

Predictive analytics is the specific application of AI that uses data, statistical algorithms, and machine learning techniques to identify the likelihood of future outcomes based on historical data. It’s the “crystal ball” component of AI investing, providing the AI driven financial insights that guide decisions.

Here’s a breakdown of how it works in practice:

- Massive Data Ingestion: An AI system pulls in an incredible volume and variety of data. This includes traditional sources like stock prices, trading volumes, and economic reports (GDP, inflation), as well as alternative data like satellite images of retail parking lots, credit card transaction data, and news sentiment analysis.

- Pattern Recognition: Machine learning algorithms sift through this data to find correlations and patterns invisible to the human eye. It might discover, for instance, that a certain combination of oil price fluctuations and social media sentiment about a tech company has historically preceded a 5% dip in that company’s stock.

- Model Building & Forecasting: Based on these patterns, the AI builds predictive models for stocks and other assets. It doesn’t just say “this stock will go up”; it calculates probabilities. For example, it might conclude there is a 75% probability a stock will rise by 3% in the next 48 hours based on current conditions.

- Actionable Insights & Execution: These predictions are then translated into action. For an individual investor, it might be a “buy” or “sell” recommendation. For a hedge fund, it could be the automatic execution of millions of dollars in trades via algorithmic trading AI.

This process allows for a level of AI market analysis that is both deeper and faster than ever before, enabling investors to react to opportunities and risks with unprecedented agility. Related: Google’s AI Overviews: The Future of Search is Here, this ability to synthesize vast information into a single output is a shared trait of modern AI systems.

The Tools of the Trade: Your Guide to Modern Financial AI Tools

The best part about the AI revolution in finance is that it’s no longer confined to billion-dollar Wall Street firms. A growing ecosystem of financial AI tools and automated investing platforms is bringing these capabilities to the masses.

Robo-Advisors 2.0: Beyond Basic Automation

The first wave of robo-advisors simply automated portfolio allocation based on a user’s risk tolerance. The robo-advisors 2024 and beyond are far more sophisticated, leveraging AI for true AI wealth management.

These next-gen platforms offer dynamic AI portfolio optimization. Instead of just rebalancing your portfolio on a fixed schedule, an AI-powered robo-advisor can monitor market conditions in real-time and make subtle adjustments to mitigate risk or seize opportunities. They offer services like advanced tax-loss harvesting and can provide personalized investment advice that adapts as your financial situation and the market change.

Algorithmic Trading Platforms: The Rise of the Quants

For more active investors, algorithmic trading AI platforms provide tools to build, test, and deploy automated trading strategies. This is the domain of quantitative trading, where strategies are based entirely on mathematical models. AI enhances this by:

- Strategy Discovery: AI can analyze market data to suggest new, potentially profitable trading strategies.

- Dynamic Adaptation: A machine learning model can adjust a trading algorithm on the fly as market conditions change, something a static algorithm cannot do.

- High-Frequency Trading (HFT): AI is essential for HFT, where trades are executed in microseconds to capitalize on tiny price discrepancies.

AI-Driven Research and Insights Platforms

Perhaps the most accessible category AI for retail investors is the rise of platforms that use AI to generate research and insights. These tools don’t manage your money directly but empower you to make better decisions. They can:

- Analyze Market Sentiment: Scan millions of articles and social media posts to give you a real-time sentiment score for a stock.

- Forecast Earnings: Use predictive models to estimate a company’s future earnings with a higher degree of accuracy.

- Identify Trends: Highlight emerging investment tech and sectoral trends before they become mainstream.

- Provide Smart Scans: Allow you to screen for stocks using complex, AI-driven criteria, such as “companies showing patterns similar to Amazon in its early growth phase.”

Understanding the workflow, from data to execution, is key to trusting these systems. The process is logical, transparent, and designed to augment human intelligence.

The Benefits of AI Investing: Speed, Precision, and Emotional Discipline

Integrating AI into your investment strategy isn’t just a novelty; it offers tangible advantages that directly address the most common pitfalls of traditional investing.

Unparalleled Data Processing and Speed

An AI can analyze decades of market data, read every financial report, and scan global news in the time it takes a human to read a single headline. This speed advantage allows for the identification of fleeting opportunities that would otherwise be missed.

Enhanced Risk Management

One of the most powerful applications of AI is in risk management AI finance. By running thousands of simulations based on various potential market shocks (e.g., an interest rate hike, a supply chain disruption), AI can help construct portfolios that are more resilient to volatility. It can identify concentrated risks in your portfolio that you may not have noticed.

Removing Emotional Bias

Fear and greed are the two biggest enemies of a successful investor. We are hardwired to sell in a panic and buy into speculative bubbles. AI has no emotions. It makes decisions based on data and probabilities, not on fear of missing out or panic selling. This provides a level of discipline that is difficult for humans to maintain.

Personalization at Scale

True personalized investment advice used to be reserved for the ultra-wealthy. AI changes that. By understanding an individual’s specific financial goals, risk tolerance, and time horizon, an AI platform can craft and manage a bespoke investment strategy, effectively democratizing investing AI for everyone. Just as Related: AI Travel Planner: Your Ultimate 2024 Guide to Smart & Seamless Trips creates a custom itinerary, financial AI creates a custom portfolio.

Identifying Hidden Opportunities

The market is full of complex, non-linear relationships. AI, especially deep learning, excels at finding these hidden patterns. It can identify “alpha” (market-beating returns) in unconventional data sources, giving its users a significant edge.

The Risks and Realities: A Balanced Look at AI in Finance

While the potential of AI investing is immense, it’s crucial to approach it with a clear understanding of its limitations and risks. This is not a magic money machine, and human oversight remains critical.

The “Black Box” Problem

Some complex deep learning models can be “black boxes,” meaning even their creators don’t know the exact reasoning behind a specific prediction. This lack of interpretability can be unnerving when significant capital is at stake.

Data Overfitting and Historical Bias

AI models learn from the past. If a model is “overfitted” to historical data, it may perform brilliantly in backtests but fail spectacularly when faced with a novel market event (a “black swan”) that has no precedent, like a global pandemic or a new type of financial crisis.

The Need for Human Oversight

AI is a powerful tool, not a replacement for human judgment. The most successful approaches involve a human-machine partnership, where AI provides data-driven insights and humans provide context, strategic oversight, and common-sense checks. Understanding how to query these systems is becoming a skill in itself, much like Related: Mastering Prompt Engineering: How to Unlock AI’s Full Potential.

Security and Algorithmic Errors

Any complex software system is vulnerable to bugs, errors, or cybersecurity threats. A small error in a trading algorithm could potentially lead to significant financial losses if not caught quickly. Choosing reputable, secure platforms is paramount.

Getting Started: How Retail Investors Can Leverage AI Today

Ready to explore the world of AI for retail investors? You don’t need a PhD in computer science or a massive budget. Here’s a practical roadmap:

- Start with a Modern Robo-Advisor: For most people, this is the best entry point. Platforms like Betterment, Wealthfront, and Vanguard’s Digital Advisor use sophisticated algorithms for portfolio management. Research the robo-advisors 2024 lineup to see which one best fits your needs.

- Use AI-Powered Research Tools: Supplement your own investment ideas with insights from AI research platforms. Services like Seeking Alpha Premium, Trade Ideas, or Tickeron can provide a data-driven second opinion on your stock picks.

- Educate Yourself Continuously: The world of fintech investing trends is moving at lightning speed. Follow reputable financial news sources, blogs, and podcasts that focus on the intersection of technology and finance.

- Understand Your Own Goals: AI is a tool to help you reach your goals, not a goal in itself. Define your risk tolerance, time horizon, and what you’re investing for (retirement, a down payment, etc.) before you let any algorithm touch your money.

- Think Long-Term: While AI can be used for short-term trading, its real power for most investors lies in AI financial planning and long-term portfolio optimization. Avoid the temptation to chase short-term algorithmic fads.

The Future of Investing: What’s Next for AI and Wealth Management?

The current state of AI in finance is just the beginning. The future of investing will be characterized by even deeper integration of intelligence and personalization.

We’re heading towards a future of “hyper-personalization,” where your investment portfolio adjusts in real-time based on your life events, spending habits, and even your long-term goals. Imagine your investment app automatically increasing your risk exposure slightly after you get a raise or shifting to more conservative assets as you approach a planned home purchase.

Generative AI, the technology behind models like those in Related: Apple Intelligence: Top AI Features Coming to iOS 18, iPadOS 18, and macOS Sequoia, will also play a huge role. It will act as a personal financial tutor, explaining complex market dynamics in simple, conversational language and helping investors understand the “why” behind their portfolio’s performance. These next gen investment tools will make sophisticated financial advice accessible to everyone.

This technological wave is creating a more efficient, accessible, and data-driven global financial market.

Conclusion

The integration of artificial intelligence and predictive analytics is the single most significant development in modern finance. It’s fundamentally changing the nature of investment decision making AI, shifting the focus from speculation to data science. For investors who embrace this change, the opportunities are enormous. By leveraging smart investing strategies powered by AI, you can gain a clearer understanding of the market, manage risk more effectively, and remove the emotional biases that so often lead to poor outcomes.

This isn’t about letting a robot take over your finances. It’s about augmenting your own judgment with the most powerful analytical tool ever created. The future of smart money management is a partnership between human insight and machine intelligence. The fintech investing trends are clear, and the tools are more accessible than ever. The only question left is: are you ready to invest in the future?

FAQs

Can AI accurately predict stock prices?

No, AI cannot predict stock prices with 100% accuracy. The market is influenced by countless unpredictable factors. However, AI can analyze historical data, market sentiment, and economic indicators to identify trends and calculate the probability of future price movements, giving investors a significant analytical edge over traditional methods.

What is the difference between AI investing and a robo-advisor?

A robo-advisor is a specific type of AI investing tool. It’s an automated platform that uses algorithms to build and manage a portfolio for you based on your risk tolerance. AI investing is a much broader field that also includes complex algorithmic trading systems, AI-powered research platforms, and predictive models used by large financial institutions.

Is AI investing safe for beginners?

AI investing can be very safe for beginners, especially when accessed through reputable, well-regulated robo-advisors. These platforms are designed to be user-friendly and typically invest in diversified, low-cost ETFs. However, as with any investment, there is always market risk involved, and it’s crucial to understand the platform you’re using.

How does AI help in portfolio optimization?

AI portfolio optimization uses machine learning to analyze thousands of potential assets and their correlations. It runs complex simulations to find the ideal mix of assets that offers the highest potential return for a specific level of risk. It can also dynamically adjust this mix in response to real-time market changes, something a human advisor could not do as efficiently.

Do you need to be a programmer to use AI for investing?

Absolutely not. The vast majority of financial AI tools available to retail investors are designed with user-friendly interfaces. Platforms like robo-advisors and AI research tools require no coding knowledge. They package the power of complex algorithms into simple, actionable insights.

What is the main limitation of using AI in finance?

The primary limitation is its reliance on historical data. AI models learn from past events and may not be able to predict the impact of unprecedented “black swan” events that have no historical parallel. This is why human oversight and a healthy dose of skepticism remain essential components of any sound investment strategy.