DePIN Investing Guide: Unlocking Decentralized Infrastructure Wealth in 2024

For decades, the physical infrastructure that powers our world—from telecommunication towers and data servers to energy grids and transportation networks—has been the exclusive domain of giant corporations and governments. But what if we could change that? What if individuals could collectively own, build, and profit from the essential services we use every day?

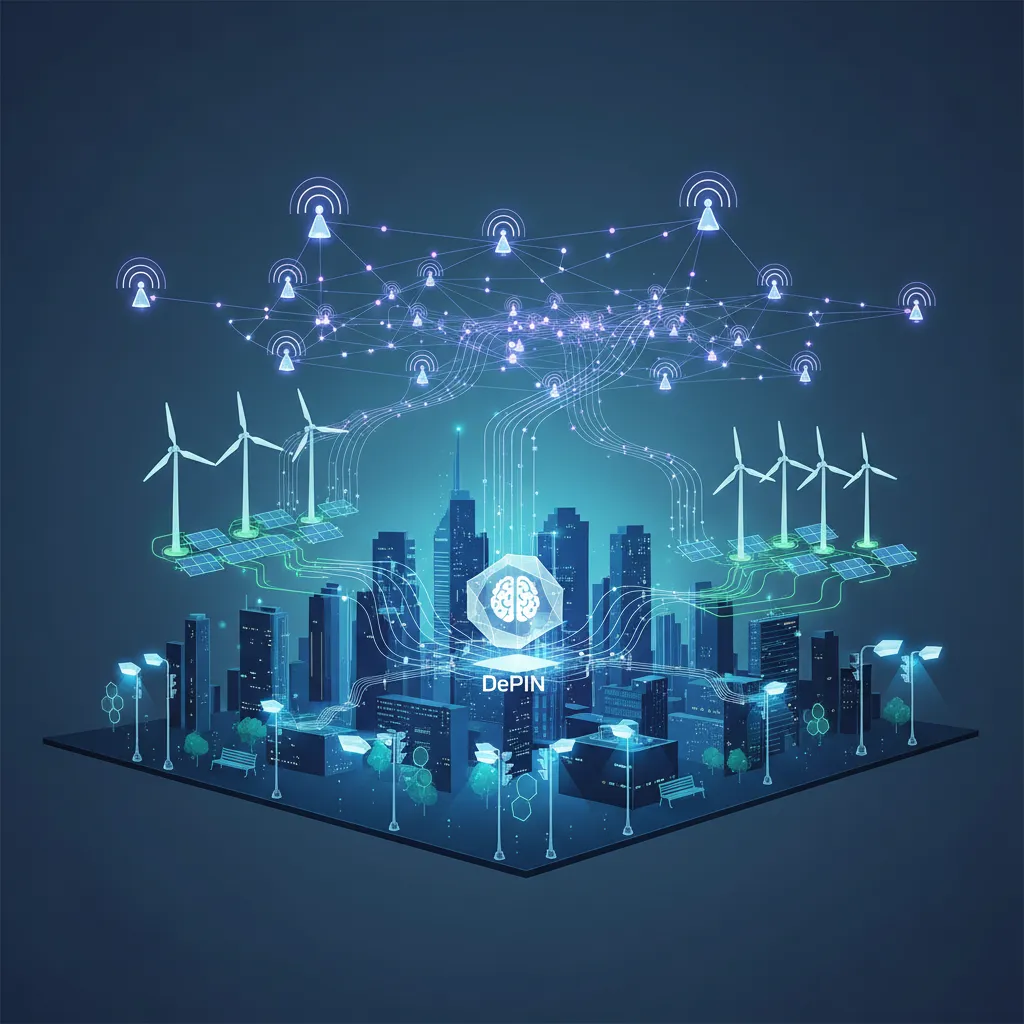

This is the revolutionary promise of DePIN, or Decentralized Physical Infrastructure Networks.

DePIN is a rapidly emerging Web3 sector that uses cryptocurrency and blockchain technology to build and maintain real-world infrastructure in a decentralized way. It’s a powerful narrative that bridges the digital world of crypto with the tangible, physical world, creating unprecedented DePIN investment opportunities.

If you’re looking for the next frontier in crypto and want to understand how you can potentially build wealth by investing in the foundational layer of our future, you’re in the right place. This guide will cover everything you need to know about DePIN investing, from the core concepts to identifying the best DePIN projects in 2024.

What is DePIN? A Revolution in Real-World Infrastructure

At its core, DePIN is a coordination mechanism. It uses a system of tokenized incentives to encourage a global network of individuals and small businesses to contribute their resources—like unused hard drive space, GPU power, or wireless bandwidth—to create a shared, usable service.

Think of it as the “Uber for infrastructure.” Uber doesn’t own a fleet of cars; it created a network that incentivizes drivers to use their personal vehicles to provide a service. Similarly, a DePIN project doesn’t build the infrastructure itself; it creates a blockchain-based protocol that rewards people for contributing their own hardware.

Beyond the Hype: DePIN Explained for Beginners

The magic behind DePIN lies in its “flywheel effect,” a self-reinforcing loop that drives network growth:

- Incentives: A new DePIN project offers DePIN cryptocurrency (tokens) to early contributors who deploy hardware and bootstrap the supply side of the network.

- Growth: As more providers join, the network’s coverage and capacity grow, making it more attractive to users and developers.

- Demand: Users, developers, and businesses start paying to use the network’s services (e.g., data storage, wireless access). These payments, often made using the network’s native token, create real economic demand.

- Value Accrual: Increased demand and usage drive up the value of the token, which in turn attracts even more hardware providers seeking higher rewards.

This flywheel transforms a capital-intensive problem (building infrastructure) into a community-driven, scalable solution.

The Two Pillars of DePIN: Physical vs. Digital Resources

The DePIN landscape can be broadly divided into two main categories based on the type of resource being decentralized:

- Physical Resource Networks (PRNs): These networks incentivize the deployment of location-dependent hardware. Examples include wireless networks (Helium), mapping networks (Hivemapper), and vehicle data networks (DIMO). Their value is directly tied to their physical coverage.

- Digital Resource Networks (DRNs): These networks incentivize the supply of digital resources that are not location-dependent. This includes services like data storage (Filecoin, Arweave), computing power (Akash), and GPU rendering power for AI and graphics (Render Network).

Understanding this distinction is key to evaluating DePIN investment opportunities, as each category has different growth models and market dynamics.

Why is DePIN Gaining So Much Traction? The Core Benefits of Investing

The buzz around DePIN isn’t just hype; it’s rooted in fundamental advantages over traditional, centralized models. For investors, these benefits translate into a compelling thesis for building wealth with DePIN.

- Massive Cost Efficiency: Crowdsourcing hardware is exponentially cheaper than the traditional model where a single company must bear the entire capital expenditure. This allows DePIN networks to offer services at a fraction of the cost of their centralized competitors.

- Unprecedented Scalability: DePIN networks can scale globally and rapidly. As long as the incentives are attractive, anyone anywhere in the world can contribute to the network, allowing it to grow organically without centralized planning.

- Decentralization & Resilience: By distributing infrastructure across thousands or even millions of nodes, DePINs eliminate single points of failure. They are more resilient to outages and censorship than centralized systems controlled by a single entity.

- Permissionless Innovation: Most DePINs are open platforms. This means other developers can build new applications and services on top of the existing infrastructure, creating a vibrant ecosystem and driving further demand.

- Passive Income Opportunities: DePIN offers a direct way to earn passive income DePIN. Whether you’re running a hardware node, staking tokens, or simply holding a valuable asset, you are participating in the network’s economy.

How to Invest in DePIN: A Step-by-Step Guide for 2024

Venturing into DePIN investing requires a blend of crypto-native knowledge and traditional investment analysis. Here’s a structured approach to get started.

Step 1: Foundational Research & Understanding the Market

Before investing a single dollar, immerse yourself in the ecosystem. Don’t just chase trends; understand the technology.

- Learn the Basics: Read project whitepapers, explore their documentation, and understand the problem they are trying to solve.

- Use Analytics Tools: Platforms like Messari, CoinGecko, and specialized DePIN aggregators provide comprehensive data on market size, token performance, and network growth metrics. A deep DePIN market analysis is non-negotiable.

- Follow Key Opinion Leaders: Follow respected analysts and DePIN-focused accounts on platforms like X (formerly Twitter) to stay updated on emerging DePIN trends.

Step 2: Choosing Your Investment Strategy

There are several ways to gain exposure to the DePIN sector. Your choice will depend on your risk tolerance, capital, and technical expertise.

- Direct Token Purchase: The simplest method is buying DePIN tokens to buy on cryptocurrency exchanges like Coinbase, Binance, or Kraken. This is a bet on the future growth and adoption of the entire network.

- Become a Service Provider: This is the most hands-on approach. It involves purchasing and operating hardware to provide services to the network and earn token rewards directly. This could mean buying a Helium hotspot, setting up a Filecoin storage node, or contributing your idle GPU to the Render Network.

- Staking & Liquidity Providing: If you already own DePIN tokens, you can often stake them to help secure the network or provide liquidity on decentralized exchanges (DEXs). In return, you earn DePIN staking rewards, compounding your investment.

Step 3: Setting Up Your Crypto Wallet and Security

Securely storing your assets is paramount.

- Choose a Wallet: You’ll need a self-custody wallet like MetaMask, Phantom, or a hardware wallet like Ledger or Trezor for maximum security.

- Prioritize Security: Never share your private keys or seed phrase. Be wary of phishing scams and use strong, unique passwords for all your accounts. Related: AI Finance Mastery: Your Guide to Smart Money Strategies

Step 4: Analyzing DePIN Projects: What to Look For

Not all DePIN projects are created equal. A rigorous evaluation framework is crucial for spotting long-term winners.

- Team and Backers: Investigate the team’s background, experience, and track record. Strong backing from reputable venture capital firms is often a positive signal.

- Tokenomics: This is the economic engine of the project. Is the token supply inflationary or deflationary? What is its utility within the ecosystem? Is the reward structure sustainable?

- Community and Network Growth: A thriving, engaged community is a leading indicator of a healthy project. Look at real-time network metrics: How many active nodes are there? Is the number growing?

- Real-World Demand: This is the most critical factor. Is there genuine, paying demand for the network’s service, or is it purely speculative? A project’s long-term success hinges on its ability to attract and retain real users.

Top DePIN Sectors and Projects to Watch in 2024

The DePIN ecosystem is vast and growing daily. Here are some of the most prominent sectors and leading crypto infrastructure projects to keep on your radar.

Disclaimer: This information is for educational purposes only and is not financial advice. Always conduct your own thorough research before making any investment decisions.

Decentralized Storage Networks

Challenging the dominance of cloud storage giants like Amazon Web Services (AWS) and Google Cloud, these networks offer cheaper, more private, and censorship-resistant DePIN data storage.

- Filecoin (FIL): The market leader, Filecoin has created a massive decentralized marketplace for data storage with over 1,000 storage providers globally.

- Arweave (AR): Specializes in permanent, one-time-fee data storage, making it ideal for archiving important information “forever.”

- Sia (SC): An older but still relevant player, Sia focuses on providing highly affordable and redundant cloud storage.

Decentralized Wireless (DeWi)

DeWi projects aim to build community-owned and operated wireless networks, offering an alternative to traditional telecom companies.

- Helium (HNT/MOBILE/IOT): The pioneer of the DeWi movement, Helium incentivizes users to deploy hotspots to create a global network for both Internet of Things (IoT) devices and 5G mobile coverage.

- Pollen Mobile: A newer entrant focused on building a decentralized mobile network in the US, allowing users to earn rewards for providing coverage.

Decentralized Compute & GPU

The rise of AI has created an insatiable demand for computing power. DePIN compute networks aggregate resources from around the world to train AI models, render complex graphics, and run applications at a lower cost. Related: The AI Content Power-Up: How to Boost Speed and Quality Today

- Akash Network (AKT): A “supercloud” for decentralized computing, allowing users to deploy Docker containers at a fraction of the cost of traditional cloud providers.

- Render Network (RNDR): A leading platform for distributing and processing complex GPU-based rendering jobs, crucial for artists, designers, and AI developers.

- io.net: A fast-growing network focused on aggregating geographically distributed GPUs specifically for machine learning and AI workloads.

Decentralized Data & Sensor Networks

These projects focus on collecting and verifying real-world data that is valuable for everything from mapping services to insurance and smart city applications.

- Hivemapper (HONEY): A decentralized mapping network that rewards contributors with dashcams for collecting street-level imagery, aiming to build a fresher, more detailed global map than Google.

- DIMO (DIMO): An open network that allows car owners to connect their vehicles, collect their own data, and share it with app developers to access better services and insights.

The Risks of DePIN Investments: A Realistic Perspective

While the potential of DePIN is immense, it’s essential to approach it with a clear understanding of the risks involved. Risks of DePIN investments are real and should not be underestimated.

- Extreme Market Volatility: Like the broader crypto market, DePIN cryptocurrency values can experience dramatic price swings.

- Technological & Execution Risk: Many projects are still in early stages. There’s a risk that the technology may not work as intended or that the team may fail to execute its vision.

- Regulatory Uncertainty: The legal landscape for digital assets is still evolving globally. Future regulations could impact DePIN projects, particularly those that blur the lines with traditional industries.

- Tokenomic Failures: A poorly designed incentive model can lead to hyperinflation or a lack of demand, causing the network’s flywheel to break and the token’s value to collapse.

- Competition: DePIN projects are taking on some of the largest and most well-funded corporations in the world. Achieving mainstream adoption in the face of such entrenched competition will be a significant challenge.

The Future of DePIN: Emerging Trends and Opportunities

The future of DePIN looks incredibly bright as it converges with other major technological trends. The synergy between AI and DePIN is particularly powerful. AI models require vast amounts of decentralized data for training and enormous amounts of decentralized computing power for operation—both of which DePIN is uniquely positioned to provide.

We are also seeing the rise of tokenized infrastructure assets bleeding into other areas like decentralized energy networks, where users can earn rewards for contributing solar power to a local grid. As the world becomes more connected through the Internet of Things (IoT), the need for decentralized networks to support these billions of devices will only grow.

Related: Apple Intelligence in iOS 18: All the AI Features Revealed at WWDC

Conclusion: Investing in the Infrastructure of Tomorrow

Decentralized Physical Infrastructure Networks represent more than just another crypto trend; they are a fundamental paradigm shift in how we build, own, and operate the physical world around us. By aligning incentives through DePIN tokens, these networks are unlocking community-driven growth at a scale and speed previously unimaginable.

For investors, DePIN offers a unique opportunity to move beyond purely digital assets and invest in the tangible, foundational layer of Web3 and the decentralized future. While the risks are significant, the potential rewards for backing the right crypto infrastructure projects could be life-changing.

The journey into DePIN investing starts with education. Dive deep, do your research, and start small. The decentralized world of tomorrow is being built today, and you have the chance to be a part of it.

Frequently Asked Questions (FAQs)

What is the main point of DePIN?

The main point of DePIN (Decentralized Physical Infrastructure Networks) is to use blockchain and token incentives to build and maintain real-world physical infrastructure—like wireless networks, data storage, or energy grids—in a more efficient, scalable, and community-owned way, breaking the reliance on large, centralized corporations.

Is DePIN a good investment?

DePIN can be a good investment, but it is high-risk. It offers the potential for high rewards by investing in a rapidly growing Web3 sector that connects crypto to the real world. However, like all cryptocurrency investments, it is subject to extreme volatility, technological risks, and regulatory uncertainty. Thorough research is essential.

What is an example of a DePIN project?

Helium is a classic example of a DePIN project. It incentivizes people worldwide to buy and deploy small hardware hotspots in their homes or offices. These hotspots create a decentralized wireless network for Internet of Things (IoT) devices and 5G cellular service, and the providers earn crypto tokens for contributing coverage.

How do you make money with DePIN?

There are two primary ways to make money with DePIN. First, you can act as a service provider by buying and running the necessary hardware (e.g., a hotspot, a storage server) to earn token rewards directly from the network. Second, you can invest by purchasing the project’s tokens on an exchange, speculating on the network’s future growth and adoption.

What is the difference between DePIN and DeFi?

DeFi (Decentralized Finance) focuses on recreating traditional financial systems like lending, borrowing, and trading on the blockchain. DePIN (Decentralized Physical Infrastructure) focuses on using the blockchain to build and manage tangible, real-world infrastructure like servers, wireless networks, and sensors. While both use tokens, DeFi is purely financial, whereas DePIN has a physical-world component.

Why is AI good for DePIN?

AI is a massive catalyst for DePIN because it creates enormous demand for the resources that DePINs provide. Training and running AI models requires vast amounts of computing power (especially GPUs) and large datasets for training. Decentralized compute and storage networks can supply these resources more affordably and efficiently than traditional cloud providers.