AI-Powered Personal Finance: Master Your Money & Invest Smarter in 2024

Remember the days of manually entering every coffee purchase into a clunky spreadsheet? Or feeling paralyzed by investment choices, ultimately stashing your savings in a low-yield account? For decades, managing money felt like a chore—reactive, time-consuming, and often shrouded in complexity. But that era is officially over. Welcome to the age of AI personal finance, where your smartphone is becoming a powerful, personalized financial advisor.

In 2024, artificial intelligence is no longer a futuristic buzzword; it’s a practical, accessible tool that’s fundamentally changing our relationship with money. This isn’t about sci-fi robots trading stocks in a cryptic backroom. This is about smart money management AI that automates your budget, uncovers hidden savings, and crafts investment strategies tailored specifically to your life goals.

This guide will demystify the world of fintech personal finance. You’ll discover how a digital financial assistant can help you conquer debt, build wealth, and achieve the financial freedom you’ve been working toward. Get ready to learn how to leverage the most innovative financial AI apps and investment tools to truly master your money.

The Dawn of the Digital Financial Assistant: What is AI Personal Finance?

At its core, AI personal finance is the use of artificial intelligence and machine learning algorithms to analyze your financial data and provide intelligent, automated, and highly personalized guidance. It moves beyond simple calculations and record-keeping to offer predictive insights and proactive recommendations.

Think of it as the difference between a static road map and a real-time GPS like Waze.

- Traditional Finance: You manually track your spending (the map), try to stick to a fixed budget, and get generic advice from a blog post. It’s a static picture of your finances.

- AI-Powered Finance: An AI system continuously analyzes your income, spending habits, bills, and investments (the real-time GPS). It doesn’t just show you where you are; it anticipates traffic jams (upcoming bills), suggests faster routes (debt-payoff strategies), and reroutes you automatically (automated savings transfers) to get you to your destination (financial goals) faster.

This shift is driven by machine learning finance, where algorithms learn from your behavior and vast datasets to become smarter and more personalized over time. The result is a suite of tools that offer personalized money advice AI that was once only available to the ultra-wealthy.

Revolutionizing Your Budget: How AI Transforms Everyday Money Management

The foundation of financial health is understanding where your money goes. This is where AI delivers its most immediate impact, turning budgeting from a tedious task into an effortless, insightful process.

Automated Expense Tracking & Categorization

The single biggest hurdle to budgeting is manual data entry. Smart budgeting apps powered by AI eliminate this entirely. By securely connecting to your bank accounts and credit cards via platforms like Plaid, they automatically import transactions and use sophisticated algorithms to instantly categorize them. That $15 charge from “SQUARE *CAFE” is correctly identified as “Coffee Shops,” not “Miscellaneous.” This gives you a crystal-clear, real-time view of your spending habits without lifting a finger.

Predictive Budgeting and Cash Flow Analysis

This is where AI truly shines. Instead of just showing you what you spent, it predicts what you will spend. Based on your history, these tools can:

- Forecast Upcoming Bills: It knows your Netflix subscription, rent, and car payment are due and will factor them into your available balance.

- Identify Spending Trends: It can alert you if your “Dining Out” category is trending higher than usual this month, allowing you to course-correct before you overspend.

- Provide “Safe-to-Spend” Balances: By analyzing your income, recurring bills, and spending patterns, the AI can tell you exactly how much you can safely spend today without jeopardizing future obligations. This level of AI financial analytics prevents accidental overdrafts and financial stress.

AI-Driven Savings: Finding Money You Didn’t Know You Had

How often do you transfer money to your savings account? For many, it’s an afterthought. AI-driven savings tools change this by making saving passive and automatic.

Apps like Digit or Acorns analyze your cash flow to identify small, safe amounts of money to pull into savings or investments. It might be $2.50 one day and $10 the next, but these “micro-savings” add up significantly over time. It’s the digital equivalent of collecting your spare change in a jar, but supercharged by an algorithm that ensures you never miss the money.

Conquering Debt with Intelligent Strategies

Debt can feel overwhelming, but AI brings clarity and strategy to the fight. AI for debt management tools can analyze all your liabilities—student loans, credit cards, personal loans—and their respective interest rates. The AI will then model different payoff scenarios, such as the “Avalanche” method (paying off highest-interest debt first) or the “Snowball” method (paying off smallest balances first for psychological wins). It helps you choose the mathematically optimal path and can even automate extra payments to accelerate your journey to being debt-free. Some platforms also specialize in AI credit score improvement, identifying the specific actions that will most effectively boost your score.

The New Era of Investing: AI as Your Personal Wealth-Building Partner

Beyond budgeting and saving, AI is democratizing the world of investing. Powerful AI wealth management tools are making it possible for anyone to build a diversified, goal-oriented portfolio.

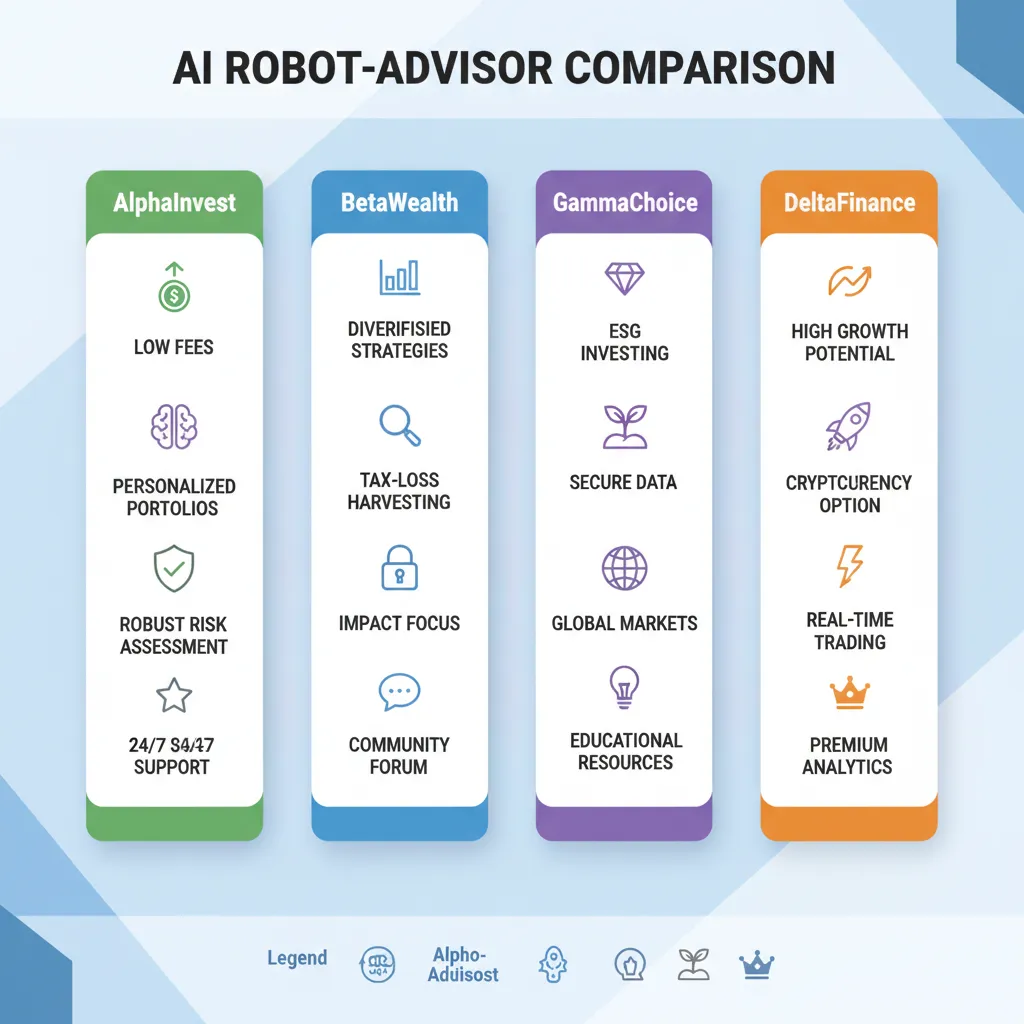

Rise of the Robo-Advisors: Automated Investing for Everyone

The most significant innovation in this space is the Robo advisors 2024 landscape. Platforms like Wealthfront, Betterment, and M1 Finance are AI-powered financial advisors that do the heavy lifting for you.

Here’s how it works:

- Onboarding: You answer a questionnaire about your financial goals, timeline, and risk tolerance.

- Portfolio Creation: The AI uses this information to construct a globally diversified portfolio of low-cost ETFs (Exchange-Traded Funds).

- Automation: The platform automatically handles everything else—reinvesting dividends, rebalancing your portfolio to maintain your target asset allocation, and even tax-loss harvesting to optimize your tax bill.

This is automated investing AI at its finest. It removes emotion from the investment process and provides a disciplined, long-term strategy that was once the exclusive domain of high-net-worth individuals. [Related: AI-Powered Investing: Predictive Analytics for Smarter Financial Decisions]

Beyond Automation: AI Investment Strategies & Stock Predictions

For the more hands-on investor, the next frontier is using AI for more active strategies. While no AI can perfectly predict the future, it can process and analyze data at a scale impossible for humans, giving you a significant edge.

- AI Stock Market Predictions: Advanced platforms use machine learning to analyze millions of data points, including financial reports, news sentiment, social media trends, and macroeconomic indicators, to identify potential market movements. They don’t offer guarantees, but they provide data-driven probabilities.

- Algorithmic Trading for Individuals: This once-exclusive Wall Street practice is now accessible. Some platforms allow you to use pre-built AI models or even create your own trading algorithms, enabling you to execute trades based on specific market signals without manual intervention. These AI investment strategies are powerful but require a deeper understanding of the market.

Personalized Financial Planning and AI Retirement Goals

Your financial life isn’t static. A promotion, a new home, or a growing family can change your entire outlook. Personalized financial planning AI excels here. These systems can create dynamic, long-term financial plans that adjust as your life evolves. You can model different scenarios for AI retirement planning: “What if I retire at 60 instead of 65?” or “How will buying a new car impact my goal of saving for a down payment?” The AI provides instant, data-backed answers, making long-term planning an interactive and adaptive process.

Building Your 2024 AI Financial Toolkit: Top Apps and Platforms

The market for financial AI apps is booming. Choosing the right tools depends on your specific needs. Here’s a breakdown of some leading categories and players shaping the next-gen personal finance landscape.

For All-in-One Money Management & Budgeting

These apps serve as your financial command center, providing a holistic view of your financial life.

- Monarch Money: A powerful tool known for its clean interface, customizable dashboards, and robust investment tracking. Its AI helps with smart categorization and projecting cash flow.

- Copilot Money: An iOS-focused app praised for its intelligent, AI-driven insights and beautiful design. It excels at surfacing spending trends you might have missed.

- YNAB (You Need A Budget): While based on a specific methodology, YNAB uses smart technology to make its “give every dollar a job” system seamless, reconciling accounts and tracking goals effectively.

For Automated Investing & Wealth Management

These platforms are designed for “set it and forget it” wealth building.

- Wealthfront: A leader in the robo-advisor space, offering automated investing, tax-loss harvesting, and high-yield cash accounts. Its AI helps tailor your portfolio and plan for major life goals.

- Betterment: Another top-tier robo-advisor that provides goal-based investing, retirement planning tools, and access to human financial advisors for an additional fee.

- M1 Finance: A hybrid platform that combines the automation of a robo-advisor with the customization of a traditional brokerage, allowing you to build your own “pies” (portfolios) that the platform automatically maintains.

For Enhancing Financial Literacy & Decision-Making

Beyond management, AI is a powerful educational tool. Many of the platforms above incorporate financial literacy AI tools that explain complex topics in simple terms, provide in-app educational content, and model the long-term impact of financial decisions, helping you become a more confident investor. [Related: Apple Intelligence: A Deep Dive into its Top AI Features]

The Human Element: Navigating the Risks and Rewards of AI Finance

Embracing AI in your finances offers tremendous upside, but it’s essential to have a balanced perspective.

The Bright Side: Benefits of Embracing Financial AI

- Accessibility: Sophisticated financial advice is no longer gated by high fees.

- Efficiency: Automating tedious tasks frees up your time and mental energy.

- Data-Driven Decisions: Removes emotion and guesswork from critical financial choices.

- Personalization: Receive guidance tailored to your unique financial situation and goals.

- Empowerment: Fosters a deeper understanding and sense of control over your finances, contributing to financial wellness AI and your journey to AI for financial freedom.

A Word of Caution: Understanding the Limitations and Risks

- Data Security: Entrusting your financial data to an app requires confidence in its security. Reputable apps use bank-level encryption and secure connectors like Plaid, but it’s always wise to use strong, unique passwords and enable two-factor authentication.

- Algorithmic Bias: AI is only as good as the data it’s trained on. There’s a risk that algorithms could perpetuate existing biases, though regulations are in place to combat this.

- Over-Reliance: AI is a tool, not a replacement for critical thinking. It’s still important to understand the basics of personal finance and to review the AI’s suggestions before acting on them.

The Horizon of FinTech: The Future of Your Finances is AI

We are only at the beginning of the AI finance revolution. The future of finance AI points toward a world of hyper-personalization. Imagine an AI that not only manages your budget but also renegotiates your cable bill, finds better insurance rates automatically, and aligns your investments with your personal values, like sustainable investing. The concept of a truly autonomous AI-powered financial advisor that manages the entirety of your financial life is rapidly moving from fiction to reality. [Related: The Circular Economy Explained: A Guide to Sustainable Living and Smart Consumption]

Conclusion: Your Financial Future, Reimagined

The integration of artificial intelligence into personal finance is the most significant leap forward in money management in a generation. It offers a clear path to greater financial control, smarter investment decisions, and a more secure future. By leveraging AI investing tools, smart budgeting apps, and robo-advisors, you can automate the mundane, gain powerful insights, and focus on what truly matters: living your life and achieving your dreams.

The power to build wealth and achieve financial wellness is no longer locked away in complex financial instruments or expensive consultations. It’s right in your pocket. Start small. Pick one area of your finances you want to improve—be it budgeting, saving, or investing—and explore an AI tool designed to help. The journey to mastering your money in 2024 begins with a single, smart, AI-powered step.

Frequently Asked Questions About AI in Personal Finance

How can AI help with personal finance?

AI can help by automating tedious tasks like expense tracking and budgeting, providing predictive insights into your cash flow, identifying hidden savings opportunities, and making sophisticated investing strategies accessible. It analyzes your financial data to offer personalized advice and helps you make smarter, data-driven decisions to reach your goals faster.

What is an example of AI in finance?

A great example is a robo-advisor like Betterment or Wealthfront. You tell it your financial goals and risk tolerance, and its AI algorithm automatically builds and manages a diversified investment portfolio for you. It handles rebalancing, dividend reinvesting, and even tax optimization, all without requiring manual intervention.

Are AI financial advisors reliable?

For the most part, yes. Reputable AI financial advisors and robo-advisors use proven investment theories (like Modern Portfolio Theory) and are regulated financial entities. They are extremely reliable for executing a disciplined, long-term, passive investment strategy. However, they lack the emotional intelligence and nuanced understanding of a human advisor, so for complex life situations, a hybrid approach can be beneficial.

Can AI predict stock prices?

AI cannot predict stock prices with 100% certainty—no one can. Instead of predicting, advanced AI uses machine learning to analyze vast amounts of data to identify patterns and calculate probabilities. It can forecast that a stock has a high probability of increasing based on historical trends and market sentiment, but it is an educated guess, not a guarantee.

What are the best AI investing tools for beginners?

For beginners, robo-advisors are the best entry point into AI investing. Platforms like Wealthfront, Betterment, and M1 Finance are user-friendly, require low minimum investments, and automatically manage your portfolio. They remove the complexity and guesswork, allowing you to start building wealth with a sound, diversified strategy.

Is my financial data safe with AI apps?

Reputable financial AI apps take security very seriously. They use bank-level, 256-bit encryption to protect your data. Most use trusted third-party services like Plaid to securely connect to your bank accounts, meaning the app never sees or stores your banking credentials. Always choose well-known apps and enable two-factor authentication for maximum security.